Week 8: Introduction to Investment Strategies

Explore the world of investing strategies—like value, growth, and index investing—and learn how to balance risk and rewards through smart asset allocation.

There are several different investment strategies we will be getting into to make your investing life run easier and smoother! The main ones include value investing, growth investing, and index investing.

But first, what is an investment strategy?

Well, that sounds pretty straightforward, but picking which investment strategy is best for you might be the issue. When picking this investment strategy, it’s important to make sure you understand your own risk tolerance, your personal investing style, and your long term financial goals.

Now, don’t worry. If you have to change your investment strategy along the way, that’s okay. But I’m here to teach you guys all the information you need to know, so you don’t have to waste that time.

I can give you guys the information about these strategies, but it’s important for you guys to know some things about yourself first.

Take a pause and ask yourself…

What is your current financial situation?

What is your cost of living (do you pay for all of this)?

How much can you realistically afford to invest?

You don’t have to know the answers to these now, but it’s something to think about.

Let’s talk about strategies.

Strategy 1: What is value investing?

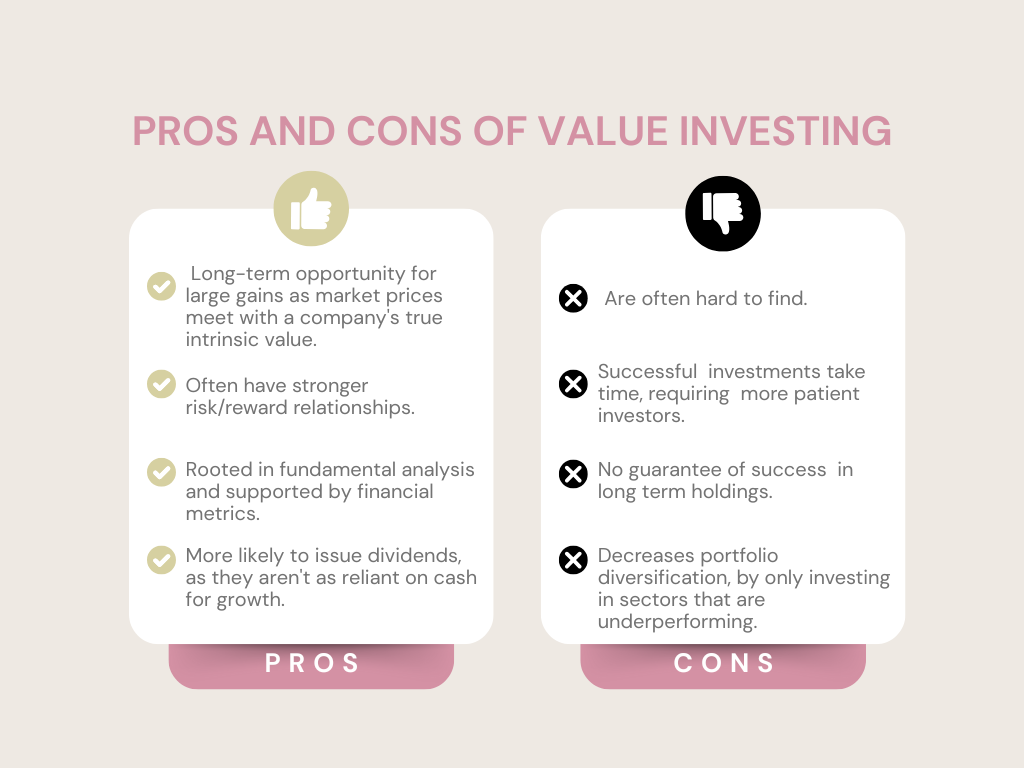

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. Value investors often buy stocks they think the stock market is underestimating. Value investors hold the belief that irrationality exists in the stock market. This irrationality of the stock market usually offers an opportunity to profit by purchasing stocks at discounted prices.

The basic concept behind everyday value investing is straightforward: If you know the true value of something, you can save a lot of money when you buy it. Here, let’s put it this way: you buy a new couch on sale, or at full price, you’re getting the same couch with the same comfort and size.

Stock prices work in a similar manner, meaning a company’s share price can change even when the company’s valuation has remained the same.

Who is this strategy best for?

This strategy is best for investors that are looking to hold securities long-term, because of the fact that value investors look at the bigger picture and are very patient in the gradual growth process of value investing. Value investors are considered “bargain shoppers” who seek stocks that are undervalued!

Strategy 2: What is growth investing?

Growth investors want investments that offer strong upside potential when it comes to the future earnings of stocks. It could be said that a growth investor is often looking for the “next big thing.” Growth investing is inherently riskier and generally only thrives during certain economic conditions.

Who is this strategy best for?

Investors looking for shorter investing horizons with greater potential than value companies are best suited for growth investing. Growth investing is also ideal for investors that are not concerned with investment cash flow or dividends.

Strategy 3: What is Index investing?

Index investing is a smart way to manage risk and aim for steady returns. Instead of trying to beat the market, it spreads your money across a wide range of stocks, reducing the risk tied to any one company. By matching the index, you get reliable performance without the stress of constant trading.

Who is this strategy best for?

It’s a great choice for beginner investors that are beginning to explore the stock market. Especially for those who feel overwhelmed by the complexity of the stock market, index investing allows you to gain exposure to a range of companies through their sectors without the need for extensive research